Powering transformative growth in, global emerging markets

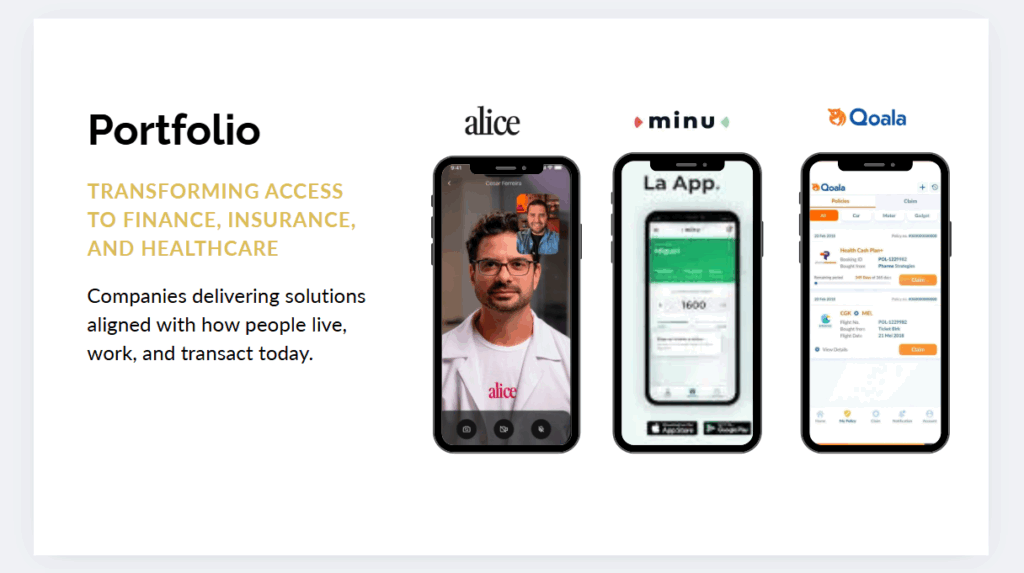

connected consumers and MSMEs. Next Billion Capital

focuses on countries where rising demand and limited

access to financial services and healthcare create

attractive opportunities for companies delivering solutions aligned with how people live, work and transact today.

The Next Billion people in emerging markets are now accessing essential services through their smartphones.

Investing in Technology Leaders Serving the Next Billion

Integrity

We uphold the highest ethical standards in every interaction, ensuring transparency, and trust in our work.

Client Focus

We uphold the highest ethical standards in every interaction, ensuring transparency, and trust in our work.

Risk Resilience

We uphold the highest ethical standards in every interaction, ensuring transparency, and trust in our work.

Expertise

We uphold the highest ethical standards in every interaction, ensuring transparency, and trust in our work.

Impact

Ruzgar Barisik

Co-Founder & Mg. Partner

Ken Toyoda

Co-Founder & Mg. Partner

Falgu Shah

Co-Founder & Mg. Partner

Vlad Tsapko

Partner

View the Latest Next Billion

News and Updates

Next Billion Capital Partners FAQ’s

Common questions and answers

What should a financial plan include?

A solid financial plan ought to cover a thorough look at your personal goals and aspirations, alongside an evaluation of your investment holdings. It should map out your expected income and expenses both before and after retirement, weigh the pros and cons of different retirement and investment account options, and outline strategies for retirement preparation, tax efficiency, charitable contributions, and safeguarding your assets through insurance.

On top of that, it should offer clear, actionable advice and steps to turn your goals into reality. To guide you toward the best decisions, a good plan will also lay out a variety of potential scenarios—plus some alternative ones—for you to consider.

Can you help me plan for retirement?

Retirement age varies widely from person to person. The big question is whether you’ve got enough saved up to support the lifestyle you’re aiming for, especially since retirement could stretch on for 30 years or longer. Your income during those years will likely come from a mix of sources: retirement accounts and savings, a pension if you have one, brokerage accounts, Social Security payments, annuity income if you’ve set that up, and any other investments you’ve built over time.

What is your investment philosophy?

We base our investment approach on evidence and decades of market history, not guesswork about the future. Research shows market timing doesn’t work. Instead, we focus on what you can control: risk, asset allocation, costs, and taxes. Emotional decisions often hurt long-term returns, so we aim to avoid those pitfalls.

Diversification lowers risk—not just by holding many assets, but by mixing company sizes, sectors, and balancing stocks and bonds. Risk can’t be erased, but it can be managed.

We keep expenses low with cost-effective mutual funds and ETFs, since high fees can erode even a well-diversified portfolio’s gains.

Taxes matter too. While unavoidable, they can be minimized with a smart, tax-aware strategy.

Will I have a dedicated advisor?

Absolutely, you’ll have your own personal advisor. At Execor, we’re all about building a strong, one-on-one connection between you and your advisor. We know everyone’s financial path is different, so we pair every client with a dedicated advisor who’s focused on getting to know you and helping you reach your unique financial goals.